Competitor intelligence and research – Competitor intelligence and research is crucial for any business aiming to succeed. It’s not just about knowing what your competitors are doing; it’s about understanding

-why* they’re doing it, and using that knowledge to shape your own strategies. This exploration dives deep into the world of competitor analysis, from defining the field to implementing effective strategies and leveraging cutting-edge tools.

This comprehensive guide covers everything from defining competitor intelligence and its key differences from market research to the crucial steps of gathering information, analyzing the competitive landscape, and developing strategies. We’ll also explore implementing and managing a competitor intelligence program, examining case studies, and finally, highlighting the essential tools and technologies available.

Defining Competitor Intelligence and Research

Understanding your competitors is crucial for success in any market. Competitor intelligence and research provide the insights needed to make informed decisions, anticipate market trends, and stay ahead of the curve. This goes beyond simply knowing what your competitors are doing; it’s about understanding

why* they’re doing it and how that impacts your strategies.

Competitor intelligence and research are the systematic process of gathering, analyzing, and interpreting data about your competitors to gain a comprehensive understanding of their strengths, weaknesses, strategies, and market positioning. This information is then used to identify opportunities, mitigate threats, and develop effective business strategies. The scope extends from their products and services to their marketing campaigns, pricing models, and customer base.

Defining Competitor Intelligence and Research

Competitor intelligence and research are not interchangeable with market research. While both involve data collection and analysis, competitor intelligence focuses specifically on your competitors, their actions, and their impact on your business. Market research, on the other hand, looks at the broader market trends, customer preferences, and industry dynamics.

Key Differences Between Competitor Intelligence and Market Research

- Competitor intelligence concentrates on the activities and strategies of your direct and indirect competitors. Market research analyzes the entire market, including trends, customer segments, and industry dynamics.

- Competitor intelligence aims to understand competitor actions and their potential impact on your business. Market research seeks to identify market opportunities and challenges.

- Competitor intelligence often uses proprietary data sources, competitive benchmarking, and analysis of competitor communications. Market research commonly utilizes surveys, focus groups, and secondary data from industry reports.

Importance of Competitor Intelligence in Strategic Decision-Making

Effective competitor intelligence informs strategic decisions across various aspects of a business. It enables proactive adjustments to market changes and competitive threats. By understanding competitor strengths and weaknesses, businesses can identify areas for innovation, differentiate their offerings, and create more effective marketing campaigns. This leads to improved market positioning, increased profitability, and sustained growth.

Different Methodologies for Competitor Intelligence and Research

Gathering information about competitors requires various methodologies. A successful approach often involves combining multiple techniques to gain a more comprehensive picture.

- Publicly Available Information Gathering: This involves analyzing publicly available data such as news articles, financial reports, social media presence, and website content. Companies often utilize tools and platforms that facilitate this type of research.

- Competitive Benchmarking: This process involves identifying key competitors and comparing their performance metrics to your own. This comparison highlights areas where you excel and areas where you need improvement.

- Direct Observation and Competitive Analysis: This includes attending industry events, reviewing competitor marketing materials, and monitoring customer interactions with competitor products or services. This often involves direct observation of the market.

- Qualitative and Quantitative Research: Understanding the motivations behind competitor actions and analyzing quantitative data, such as sales figures and market share, provide a deeper understanding of their strategies.

Gathering Information

Unveiling your competitors’ strategies and market positions requires a systematic approach to data collection. This crucial step empowers informed decision-making and provides valuable insights for refining your own business tactics. A well-structured framework for gathering information is paramount, encompassing both publicly available resources and potentially sensitive proprietary data.Gathering comprehensive competitor intelligence is not merely about amassing information; it’s about discerning actionable insights.

A robust strategy involves carefully selecting the right data sources, analyzing the gathered information, and drawing conclusions that inform your business decisions. This process is crucial for competitive advantage in today’s dynamic marketplace.

Designing a Framework for Collecting Data

A systematic framework for collecting competitor data ensures comprehensive coverage and efficient information processing. This framework should encompass various data sources, including public records, industry reports, and social media. It should be adaptable and allow for adjustments as new information emerges or competitive landscapes shift. A well-defined framework ensures you are not just gathering information, but extracting actionable intelligence.

Methods for Gathering Open-Source Information

Open-source intelligence (OSINT) provides a wealth of readily accessible data about competitors. Utilizing online databases, news archives, and industry reports can offer significant insights into competitors’ products, services, marketing strategies, and financial performance. This approach leverages readily available information to gain a deeper understanding of your competitors.

- News Articles and Press Releases: Monitoring industry news outlets and company press releases provides real-time updates on product launches, marketing campaigns, and strategic partnerships. Staying abreast of these developments helps you anticipate competitor actions and adjust your strategies accordingly.

- Financial Reports and SEC Filings: Analyzing financial reports and SEC filings allows you to assess a competitor’s financial health, profitability, and potential growth trajectory. These documents reveal crucial insights into their business performance and market position.

- Industry Reports and Market Research: Industry reports and market research provide valuable context and trends in the market. These reports frequently include data on competitor market share, sales figures, and technological advancements, which are useful for developing informed business strategies.

- Company Websites and Online Resources: Competitor websites, social media profiles, and other online resources offer direct access to information about their products, services, and brand image. This information helps you understand their target audience and marketing approach.

Strategies for Accessing Proprietary Information

Accessing proprietary information about competitors necessitates ethical considerations and adherence to legal boundaries. A strategic approach focuses on identifying publicly available data that indirectly reveals proprietary insights. For example, reverse engineering publicly available information, analyzing competitor marketing materials, or observing their product development patterns. This approach can offer valuable clues about their business strategies without violating any confidentiality agreements.

Publicly Available Resources for Competitor Intelligence

Numerous publicly accessible resources provide valuable data points for competitor analysis. These resources range from government databases to industry-specific publications, offering insights into competitors’ operations and market positioning.

- Government Databases: Government databases often contain valuable information on company registrations, business licenses, and regulatory filings, providing insights into competitors’ operations and compliance status.

- Industry Associations: Industry associations often publish reports and analyses that provide a comprehensive view of the competitive landscape. These reports often contain data on market trends, competitor profiles, and sales figures.

- Market Research Firms: Market research firms conduct in-depth studies and analyses of various industries, offering valuable insights into competitor market share, strategies, and financial performance.

Leveraging Social Media Platforms for Competitor Analysis

Social media platforms provide a rich source of information about competitor activities. Tracking mentions, monitoring brand sentiment, and analyzing customer interactions can offer significant insights into how competitors are engaging with their target audience. This enables a comprehensive understanding of customer perception and brand image.

- Monitoring Social Media Mentions: Tracking competitor mentions on social media platforms allows you to gauge public sentiment towards their products and services. This insight can reveal areas for improvement or opportunities for your own brand.

- Analyzing Customer Interactions: Analyzing how customers interact with competitors on social media can reveal valuable insights into their product features, marketing approaches, and customer service practices.

Comparing Information Sources

A comprehensive competitor analysis requires a structured approach to evaluating various information sources.

| Information Source | Strengths | Weaknesses |

|---|---|---|

| News Articles | Real-time updates on events and activities | Potential for biased reporting |

| Financial Reports | Insight into financial performance | Limited insight into operational strategies |

| Social Media | Customer sentiment and brand perception | Potential for misleading or incomplete information |

Analyzing Competitive Landscape

Understanding your competitors is crucial for strategic decision-making. A thorough analysis of the competitive landscape reveals strengths, weaknesses, and opportunities, enabling businesses to adjust their strategies accordingly. This in-depth understanding helps to anticipate competitor actions, refine product offerings, and enhance overall market positioning.Thorough competitive analysis provides a clear picture of the market dynamics, allowing businesses to identify potential threats and proactively develop countermeasures.

This comprehensive understanding allows for more informed decisions about product development, pricing, marketing, and resource allocation.

Identifying Competitor Strengths and Weaknesses

A critical aspect of competitive analysis is identifying the strengths and weaknesses of competitors. This involves examining their products, services, marketing strategies, financial performance, and overall market presence. By pinpointing their strengths, you can anticipate their potential moves and formulate strategies to counteract them. Conversely, understanding their weaknesses allows for the development of strategies that exploit those vulnerabilities and capitalize on market opportunities.

Understanding your competitors is key in any market analysis. Knowing what your rivals are doing, especially on platforms like Snapchat, is crucial for effective strategies. For instance, studying how brands can use Snapchat for marketing campaigns how brands can use snapchat gives you valuable insight. This competitive research then helps you refine your own Snapchat approach, ultimately strengthening your brand’s position in the digital landscape.

Evaluating Competitor Products and Services

Evaluating competitor products and services requires a systematic approach. This involves analyzing features, functionalities, quality, design, and user experience. Comparative analysis of key features and benefits helps in identifying areas where your product or service can outperform the competition. Direct customer feedback and reviews can provide valuable insights into perceived strengths and weaknesses of competitor offerings.

Analyzing Competitor Pricing Strategies, Competitor intelligence and research

Understanding competitor pricing strategies is vital for developing your own pricing model. This involves examining pricing models (e.g., cost-plus, value-based, competitive), discounts, promotions, and any price fluctuations over time. Analysis of competitor pricing strategies helps in understanding the prevailing market price points and identifying potential pricing gaps. Observing competitor pricing adjustments and correlating them with sales trends can reveal insights into their pricing strategies’ effectiveness.

Evaluating Competitor Marketing Strategies

Evaluating competitor marketing strategies involves examining their marketing channels (e.g., social media, advertising, public relations), messaging, brand positioning, and target audience. Identifying their successful marketing campaigns and their weaknesses provides insights into effective and ineffective approaches. This allows you to tailor your marketing strategies, optimizing your messaging and channels for better reach and impact.

Assessing Competitor Market Share

Assessing competitor market share involves analyzing their sales volume, market penetration, and brand awareness within the target market. Market research reports and industry analysis provide valuable data on market share trends. Knowing the competitor’s market share helps you understand their relative position in the market and identify potential opportunities to capture a larger market share.

Key Performance Indicators (KPIs) for Evaluating Competitors

| KPI | Description | How to Measure |

|---|---|---|

| Market Share | Percentage of the total market controlled by a competitor. | Divide competitor’s sales volume by total market sales volume. |

| Sales Revenue | Total revenue generated by a competitor. | Gather data from financial reports or industry analysis. |

| Customer Acquisition Cost (CAC) | Cost of acquiring a new customer. | Divide total marketing and sales expenses by the number of new customers acquired. |

| Customer Lifetime Value (CLTV) | Total revenue a customer is expected to generate throughout their relationship with a company. | Calculate projected revenue from a customer’s purchase history and projected future purchases. |

| Product Quality Scores | Customer ratings and reviews regarding product quality. | Analyze customer reviews and ratings on online platforms. |

| Brand Awareness | Recognition of a brand in the market. | Use surveys and brand tracking studies. |

| Website Traffic | Number of visitors to a competitor’s website. | Use web analytics tools. |

Developing Competitive Strategies

Competitive intelligence is more than just gathering information; it’s a crucial tool for shaping strategic decisions. By understanding your competitors’ actions, strengths, weaknesses, and market positioning, you can proactively develop strategies that give you a competitive edge. This process requires not only data collection but also a keen analysis of the implications of that data on your business objectives.Effective competitive intelligence empowers proactive strategy development.

By anticipating competitor moves and market trends, businesses can adjust their strategies to maintain or gain a stronger position. This proactive approach is essential in dynamic markets where swift adaptation is key to survival and growth.

Using Competitor Intelligence to Inform Strategic Decisions

Competitive intelligence provides the foundation for informed strategic decisions. By analyzing competitor activities, market trends, and customer preferences, businesses can make data-driven choices about product development, pricing, marketing, and distribution. This approach ensures strategies are tailored to maximize profitability and minimize risks.

Examples of Competitive Strategies Based on Intelligence Research

Numerous examples demonstrate the application of competitive intelligence in strategic decision-making. For instance, a company observing a competitor launching a new product with innovative features might decide to either improve their existing offerings with similar enhancements or preemptively release an upgraded version of their own product. Another example involves a company identifying a competitor’s weakness in customer service and leveraging this insight to enhance its own customer support processes.

These strategic adaptations are direct results of competitor intelligence.

Relationship Between Competitor Intelligence and Innovation

Competitor intelligence is intrinsically linked to innovation. By monitoring competitor activities, businesses can identify emerging trends and technologies. This knowledge can inspire the development of innovative solutions and products, potentially disrupting existing market structures. By anticipating future needs and emerging technologies, companies can create new products and services that surpass existing offerings. For example, a company noticing competitor advancements in a specific technology area might decide to allocate resources to develop a related technology that surpasses the competition.

Understanding your competitors is key to any successful marketing strategy. Competitor intelligence and research helps you pinpoint their strengths and weaknesses, allowing you to identify gaps in the market and craft a compelling strategy. Knowing this, you can leverage that insight to, for example, “steal your competition’s followers” steal your competitions followers. This, in turn, informs your next steps, refining your strategy and improving your competitive advantage.

This kind of competitor intelligence research is crucial for long-term growth.

Adapting Strategies Based on Competitor Actions

The competitive landscape is dynamic. Competitors constantly adapt, launching new products, adjusting prices, or changing marketing strategies. Strategic flexibility is crucial to counter these actions. Companies must be agile and prepared to adjust their plans based on competitor reactions. This includes adjusting pricing, product features, marketing campaigns, and distribution channels.

A competitor’s aggressive pricing strategy, for example, may prompt a company to offer more competitive pricing or emphasize unique product features.

Importance of Continuous Monitoring of the Competitive Landscape

The competitive landscape is not static. Competitor intelligence requires continuous monitoring. Regularly evaluating competitor activities and market trends provides a proactive approach to strategic decision-making. This continuous monitoring ensures that strategies remain relevant and effective. Failing to monitor competitors can result in a loss of market share, outdated strategies, and missed opportunities.

The competitive environment is always evolving, necessitating a consistent effort to stay ahead of the curve.

Table Outlining Different Competitive Strategies and Their Potential Impact

| Competitive Strategy | Potential Impact |

|---|---|

| Cost Leadership | High market share, strong profitability (in low-cost segments), potential for lower profit margins in high-cost segments. |

| Differentiation | Premium pricing, brand loyalty, higher profitability, vulnerability to imitation. |

| Focus | High market share in niche markets, specialized products or services, high profitability in target segments, vulnerability to competition in broader markets. |

| Innovation | Product differentiation, market disruption, new revenue streams, high initial investment costs. |

Implementing and Managing Competitor Intelligence: Competitor Intelligence And Research

Putting competitor intelligence into action requires careful planning and execution. Simply gathering data isn’t enough; it’s crucial to establish a structured process for interpreting, analyzing, and using that information to inform strategic decisions. A robust competitor intelligence program fosters a proactive approach to market dynamics, enabling organizations to anticipate competitor moves and adapt their strategies accordingly.A well-implemented competitor intelligence program offers a competitive edge by providing actionable insights into competitor strengths, weaknesses, and future plans.

This proactive understanding allows organizations to adjust their strategies in response to competitor actions, potentially gaining a significant advantage in the market.

Best Practices for Implementing a Competitor Intelligence Program

A successful competitor intelligence program hinges on a well-defined structure. Key best practices include establishing clear objectives, defining the scope of intelligence gathering, and choosing appropriate data sources. Prioritizing relevant information and aligning it with organizational goals is essential. Furthermore, maintaining regular reviews and adjustments to the program is critical to its ongoing effectiveness.

- Establish Clear Objectives: Define specific, measurable, achievable, relevant, and time-bound (SMART) objectives for the intelligence gathering process. These should directly relate to strategic goals, such as identifying new market opportunities, understanding competitor strategies, or anticipating potential threats.

- Define the Scope: Clearly delineate the scope of the intelligence gathering. Specify the competitors to be analyzed, the types of information to be collected, and the timeframe for the program.

- Select Appropriate Data Sources: Identify and utilize a variety of reliable data sources, such as industry reports, news articles, social media, and competitor websites. Consider both publicly available information and potentially proprietary sources.

- Prioritize Information: Develop a system for prioritizing collected intelligence based on its relevance to organizational goals. Focus on data that directly impacts strategic decision-making.

- Regularly Review and Adjust: Implement a system for regular review and adjustments to the program. This includes evaluating the effectiveness of the intelligence gathering methods, analyzing the insights gained, and adapting the program based on new information or changing market conditions.

Role of Technology in Supporting Competitor Intelligence

Technology plays a crucial role in automating and enhancing competitor intelligence activities. Tools such as social listening platforms, competitive analysis software, and market research databases streamline the process of collecting and analyzing data. These tools facilitate the identification of patterns and trends, leading to more informed decisions.

- Social Listening Platforms: These tools monitor online conversations, social media posts, and news articles related to competitors, providing real-time insights into public perception and market trends.

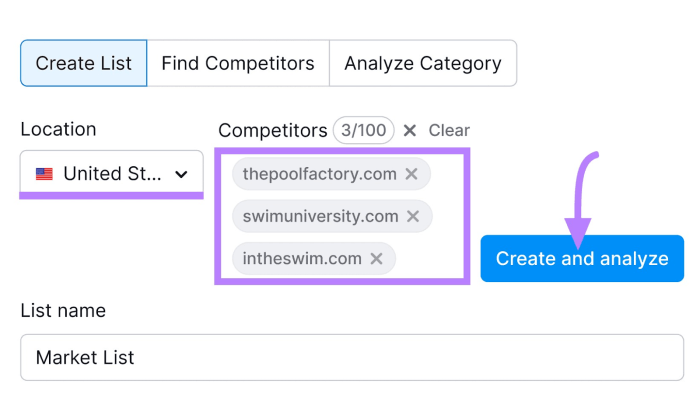

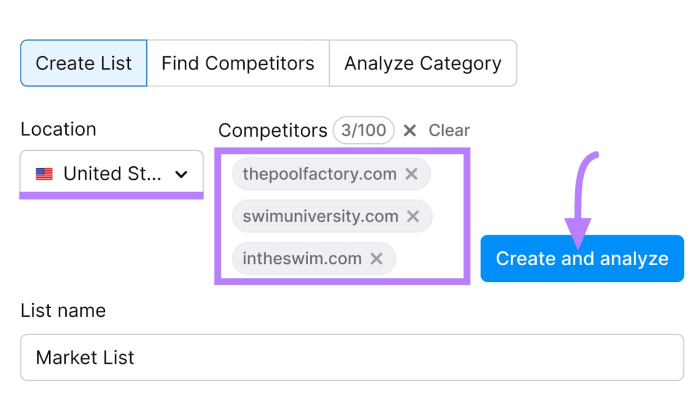

- Competitive Analysis Software: This software aids in gathering and organizing data on competitors, identifying their strengths and weaknesses, and tracking their market share. This allows for more efficient analysis of competitor activities.

- Market Research Databases: These databases provide detailed information on market trends, consumer behavior, and competitor activities. Access to such comprehensive data enhances the understanding of the competitive landscape.

Importance of Establishing a Process for Managing Collected Intelligence

A structured process for managing collected intelligence is essential for maximizing its value. This process ensures that information is properly categorized, stored, and accessed by authorized personnel. It also enables the creation of reports and presentations for strategic decision-making.

- Categorization and Storage: Implement a system for classifying and storing collected intelligence based on relevance, source, and date. This ensures that data is readily accessible for future analysis.

- Access Control: Establish clear access controls to protect sensitive information and maintain confidentiality. Only authorized personnel should have access to specific intelligence data.

- Reporting and Dissemination: Create regular reports summarizing key intelligence findings and their implications for organizational strategy. Disseminate these reports to relevant stakeholders.

Role of Personnel in Competitor Intelligence Research

Dedicated personnel play a critical role in effectively managing and executing competitor intelligence activities. Their skills and experience contribute significantly to the success of the program.

- Specialized Skills: Personnel involved in competitor intelligence research need a combination of analytical, research, and communication skills. Expertise in market research, data analysis, and report writing is invaluable.

- Industry Knowledge: A strong understanding of the industry and the specific competitors is crucial. Personnel with this background can effectively interpret data and provide meaningful insights.

- Information Gathering Skills: The ability to gather data from various sources, including public and proprietary data, is essential. Effective communication and networking skills can also facilitate information gathering.

Responsibilities of Different Roles in a Competitor Intelligence Team

A dedicated team is crucial for successful competitor intelligence. Clearly defined roles and responsibilities ensure smooth operation and maximum output.

| Role | Primary Responsibilities |

|---|---|

| Intelligence Analyst | Gathering, analyzing, and interpreting data on competitors; preparing reports and presentations; identifying key trends and insights. |

| Data Analyst | Developing and applying data analysis techniques to identify patterns and insights from gathered information; providing quantitative assessments of competitor performance. |

| Research Specialist | Conducting thorough research on competitors, collecting information from diverse sources; maintaining a database of competitor intelligence. |

| Manager | Overseeing the competitor intelligence program; setting objectives; allocating resources; ensuring the program aligns with organizational goals; evaluating program effectiveness. |

Case Studies of Effective Competitor Intelligence

Understanding your competitors is crucial for any business aiming for sustained success. Effective competitor intelligence isn’t just about gathering data; it’s about strategically analyzing that data to anticipate market shifts, identify vulnerabilities, and capitalize on opportunities. This section delves into real-world examples to demonstrate the tangible benefits of a well-executed competitor intelligence program.

Examples of Successful Competitor Intelligence Implementation

Several companies have successfully leveraged competitor intelligence to gain a significant advantage in their respective industries. Netflix, for instance, meticulously tracks its competitors’ content offerings, subscriber growth, and pricing strategies. This allows them to proactively adapt their own content strategies, pricing models, and marketing campaigns to stay ahead of the curve and maintain their market dominance. Similarly, Amazon uses competitor intelligence to understand the offerings and strategies of other e-commerce giants, enabling them to continuously refine their logistics, product selection, and customer service to remain competitive.

Knowing your competitors is key in any market, and competitor intelligence and research is crucial for success. Understanding their strategies, particularly their marketing tactics, is vital. This includes seeing where they’re spending the most, and a recent report highlights that companies spend most on paid search companies spend most on paid search. This insight can be invaluable for refining your own approach to online visibility and potentially crafting strategies that outperform them.

In essence, competitive intelligence and research are powerful tools for a successful business strategy.

Challenges and Opportunities in Competitor Intelligence

Implementing a robust competitor intelligence program comes with its own set of challenges. Data collection and analysis can be time-consuming and resource-intensive. Staying current with the ever-evolving market dynamics is another significant hurdle. However, the opportunities are substantial. A well-structured intelligence program provides insights into competitor weaknesses, market trends, and emerging technologies.

This knowledge allows businesses to adjust their strategies and adapt more swiftly to changing conditions. Moreover, it helps companies to identify potential threats and capitalize on opportunities before competitors do.

Contribution to Company Success in Various Industries

Competitor intelligence is invaluable across diverse industries. In the tech sector, companies like Google use competitor intelligence to understand and anticipate the evolution of search algorithms and user preferences, enabling them to stay ahead of the competition. In the pharmaceutical industry, competitor intelligence plays a pivotal role in understanding the research and development efforts of rivals, potentially enabling the development of new medications and treatments.

In retail, understanding competitor pricing strategies, product lines, and marketing campaigns can help businesses optimize their own offerings.

Preventing Costly Mistakes through Competitor Intelligence

Companies often overlook the significance of competitor intelligence, leading to costly mistakes. For example, neglecting to monitor a competitor’s innovative product launches can result in losing market share. Similarly, a lack of awareness regarding pricing strategies can expose the company to potential revenue losses. A proactive competitor intelligence approach allows businesses to identify these risks early on, enabling them to adjust their strategies and mitigate potential setbacks.

Importance of Staying Ahead of Competitors

In today’s competitive landscape, staying ahead of the curve is essential for survival. Competitor intelligence provides the necessary insights to anticipate changes in consumer behavior, market trends, and emerging technologies. By proactively monitoring and analyzing competitor actions, companies can identify potential threats and capitalize on emerging opportunities. This proactive approach enables businesses to adapt to market shifts, maintain their market position, and ultimately achieve long-term success.

Key Learnings from Case Studies

| Company | Successes | Challenges |

|---|---|---|

| Netflix | Proactive adaptation of content strategies, pricing models, and marketing campaigns | Maintaining data accuracy and analyzing complex market dynamics |

| Amazon | Continuous refinement of logistics, product selection, and customer service | Keeping pace with rapid technological advancements and evolving customer expectations |

| Understanding and anticipating the evolution of search algorithms and user preferences | Adapting to changing search algorithms and user behavior |

Tools and Technologies for Competitor Intelligence

Staying ahead in the competitive landscape demands a deep understanding of your rivals. Sophisticated tools and technologies are essential for efficiently gathering, analyzing, and interpreting competitor data, enabling proactive strategic decisions. This section dives into the world of competitor intelligence tools, highlighting their advantages and disadvantages, and demonstrating their practical application.

Software Tools for Gathering and Analyzing Competitor Data

Various software solutions cater to different needs in competitor intelligence. Choosing the right tool depends on the specific requirements and budget of the organization. These tools range from basic spreadsheet applications to sophisticated enterprise-level platforms.

- Spreadsheet Software (e.g., Excel, Google Sheets): These tools are readily available and cost-effective, especially for smaller organizations or initial competitive analysis. They can be used for basic data entry, simple calculations, and basic visualizations. However, their limitations become apparent as the volume and complexity of data increase. Manual data entry and the lack of advanced analytics capabilities make them less efficient for large-scale projects.

Example use: Tracking competitor pricing changes or creating simple SWOT analyses.

- Market Research Platforms (e.g., Statista, IBISWorld): These platforms provide valuable industry reports, market trends, and competitor profiles. They often offer subscription-based access, providing detailed information about competitors, but their scope may be limited, not offering real-time data. Example use: Understanding market share, growth forecasts, and identifying key competitors in a particular niche.

- Social Media Monitoring Tools (e.g., Brand24, Hootsuite): These tools are vital for tracking competitor social media activity, brand mentions, and customer sentiment. They can detect emerging trends and competitor strategies. They allow for comprehensive data analysis and reporting, but might require dedicated resources for efficient utilization.

- Competitive Intelligence Platforms (e.g., Clearbit, Datanyze): These platforms are tailored for gathering and analyzing competitor data. They provide comprehensive information on company details, financial data, products, and market positioning. Their sophistication often comes with a premium price tag, but offer detailed reports and customizable dashboards, ideal for companies needing in-depth analyses. Example use: Tracking competitor product launches, sales figures, and market positioning.

Advantages and Disadvantages of Different Tools

Choosing the right tool requires weighing its strengths and weaknesses against your needs.

- Spreadsheet Software offers ease of use and low cost but lacks advanced analytics. Its limited scalability hinders its effectiveness for large-scale projects.

- Market Research Platforms provide valuable industry insights but may not offer real-time data. Subscription fees can be a significant cost.

- Social Media Monitoring Tools track competitor social media activity and sentiment, but require significant time and effort to analyze effectively.

- Competitive Intelligence Platforms provide comprehensive data and analytics but often come with a higher price tag and require specialized knowledge to utilize effectively.

Data Visualization in Competitor Intelligence

Visualizing competitor data is crucial for effective analysis and strategic decision-making. Visual representations of data, like charts and graphs, transform complex information into easily understandable insights.

- Data visualization tools (e.g., Tableau, Power BI) transform complex datasets into easily digestible charts and graphs. They enable you to identify trends, patterns, and anomalies in your competitor data. By presenting the data in visual formats, you can quickly spot key insights that might otherwise be missed in raw numbers. Example use: Plotting competitor sales figures over time, showcasing market share shifts, or highlighting customer demographics.

Utilizing Specific Tools for Data Collection

Implementing a data collection strategy using the right tools is crucial for competitor intelligence. The process typically involves identifying data sources, creating specific queries, and automating the collection process.

- Gathering data from public sources (e.g., company websites, press releases, social media) can be achieved by using web scraping techniques. Example use: Automating the collection of competitor product specifications or pricing information from their websites.

Utilizing Specific Tools for Analysis and Reporting

Data analysis is crucial for turning raw data into actionable insights.

- Data analysis tools (e.g., Excel, Tableau) can be used to identify patterns, trends, and anomalies in your collected data. Example use: Comparing competitor pricing strategies, assessing product features, or identifying market trends. Creating reports from these analyses is crucial to share findings with stakeholders.

Comparison of Competitor Intelligence Software Tools

A table summarizing the features, pros, and cons of different tools can aid in choosing the most appropriate software.

| Tool | Pros | Cons | Use Cases |

|---|---|---|---|

| Spreadsheet Software | Low cost, readily available | Limited analytics, manual data entry | Basic analysis, small datasets |

| Market Research Platforms | Industry insights, competitor profiles | Limited real-time data, subscription fees | Market research, competitor analysis |

| Social Media Monitoring Tools | Track competitor activity, customer sentiment | Requires significant analysis effort | Brand monitoring, social listening |

| Competitive Intelligence Platforms | Comprehensive data, analytics | High cost, requires specialized knowledge | In-depth competitor analysis, strategic planning |

Epilogue

In conclusion, mastering competitor intelligence and research is paramount for any organization seeking a competitive edge. By understanding your competitors’ strengths and weaknesses, you can develop effective strategies, anticipate their moves, and ultimately position your company for long-term success. This detailed overview provides a roadmap to navigating the complexities of competitor analysis and achieving a deeper understanding of the market.