10 characteristics of professional services firms that influence their valuations sets the stage for understanding how these firms are evaluated. From firm structure and culture to revenue streams and profitability, each element plays a crucial role in shaping the final valuation. This deep dive explores the key factors that contribute to a firm’s worth, revealing the intricate interplay of internal and external forces that impact success and value.

This analysis examines how firm structure, client relationships, revenue models, talent acquisition, technological proficiency, regulatory compliance, geographic reach, financial performance, sustainability, and social responsibility all contribute to a firm’s valuation. Understanding these characteristics allows investors, potential buyers, and internal stakeholders to assess the true worth of a professional services firm, guiding strategic decisions and investment strategies.

Firm Structure and Culture

Professional services firms, encompassing law firms, consulting firms, and accounting firms, exhibit diverse organizational structures that significantly impact their valuations. These structures, alongside the firm’s culture and management style, play a crucial role in determining the market’s perception of the firm’s long-term viability and earning potential. Understanding these factors is essential for investors and potential partners alike.The inherent complexities of professional services valuations often stem from the intangible nature of their assets.

Tangible assets like physical space are less critical compared to the reputation, expertise, and relationships cultivated by the firm. Consequently, factors like firm structure and culture, which are often intertwined with the human capital within the firm, become paramount valuation drivers.

Organizational Structures

Professional services firms adopt various organizational structures, each with its own governance and operational implications. Partnerships, limited liability partnerships (LLPs), and corporations are common structures. Partnerships, often found in law firms, distribute ownership and profit based on partnership agreements, while corporations offer limited liability to shareholders. LLPs balance the liability protection of corporations with the partnership structure’s flexibility.

Influence of Firm Culture

Firm culture significantly impacts valuation. A collaborative culture, fostering knowledge sharing and teamwork, can attract and retain talent, leading to higher valuations. Conversely, a highly competitive or risk-averse culture can hinder innovation and growth, potentially lowering the firm’s value. The prevailing culture within the firm reflects its ability to adapt to market changes, a key factor in long-term success and valuation.

Impact of Management Styles and Decision-Making

Management styles and decision-making processes directly influence the firm’s performance and, consequently, its valuation. Decentralized decision-making, empowering partners or employees, can foster innovation and agility. Conversely, a highly centralized structure, while potentially efficient in the short term, can stifle innovation and responsiveness to market changes. Effective management, characterized by clear communication and transparent decision-making, positively correlates with valuation.

Governance Structures and Their Impact on Valuation

The governance structures of different professional service firms vary widely, affecting their valuations. Partnerships, for example, are governed by partnership agreements outlining profit sharing, decision-making authority, and dispute resolution. Corporations are governed by corporate bylaws and a board of directors, providing a different framework for decision-making and accountability. LLPs typically have more defined liability protections, impacting the firm’s perception in the market and ultimately influencing its valuation.

Typical Organizational Structures and Valuation Drivers

| Organizational Structure | Common Valuation Drivers |

|---|---|

| Partnerships | Partnership agreements, profitability, reputation, client base, partner experience, and market share. |

| Limited Liability Partnerships (LLPs) | Profitability, liability protection, partner experience, and client base. |

| Corporations | Profitability, management team, market share, brand recognition, and financial stability. |

Client Relationships and Market Position

Professional services firms rely heavily on strong client relationships and a robust market position for sustained growth and profitability. These factors directly impact valuation, as investors assess not only current performance but also the firm’s potential for future success. A firm with a loyal client base and a strategic market presence is typically perceived as more valuable than one with inconsistent client relationships and a less defined niche.

Understanding these dynamics is crucial for firms seeking to maximize their worth.

Client Retention Rates

Client retention is a critical indicator of a firm’s ability to deliver value and build lasting partnerships. Factors influencing retention rates include the quality of service provided, responsiveness to client needs, proactive communication, and the establishment of clear expectations. A commitment to client satisfaction, including actively seeking feedback and addressing concerns, significantly contributes to long-term relationships. Innovative approaches to service delivery, leveraging technology and adopting new methodologies, can also improve retention by increasing efficiency and exceeding client expectations.

Firms with high client retention rates often exhibit strong client loyalty and positive word-of-mouth referrals, which further enhance their market position.

Client Diversification Impact on Valuation

Client diversification, the practice of working with a variety of clients across different industries and sectors, plays a significant role in firm valuation. A diverse client base reduces the risk associated with dependence on a single client or industry downturn. This resilience is a key factor for investors, as it indicates a firm’s ability to adapt and maintain profitability even during economic fluctuations.

A diversified portfolio provides a more stable revenue stream and a wider range of potential growth opportunities.

Strategic Alliances and Partnerships

Strategic alliances and partnerships can enhance a professional services firm’s market reach and expertise. These collaborations can provide access to new clients, technologies, and markets. For example, a firm specializing in financial consulting might partner with a firm specializing in tax preparation to offer a more comprehensive suite of services to clients. The value of such partnerships often stems from the complementary skills and resources that each firm brings to the table.

Successful partnerships also strengthen the firm’s brand reputation and credibility within the industry.

Brand Reputation and Professional Networks

A strong brand reputation and extensive professional networks are crucial assets for professional services firms. A positive reputation is built over time through consistent delivery of high-quality services and client satisfaction. Strong networks provide access to potential clients, referrals, and opportunities for collaboration. Professional networks often extend beyond individual clients and can encompass industry associations, conferences, and other professional forums.

The value of these networks lies in their ability to enhance the firm’s visibility, credibility, and overall market position.

Valuation Implications of Different Client Portfolios

| Client Portfolio Type | Valuation Implications |

|---|---|

| Highly Concentrated (few large clients) | Higher risk, potential for significant revenue fluctuations, less resilient to market changes. |

| Moderately Diversified (mix of clients across industries) | Balanced risk profile, moderate revenue stability, greater adaptability to market changes. |

| Highly Diversified (clients across diverse industries and sectors) | Lowest risk, more stable revenue streams, greater resilience to market changes, higher valuation potential. |

A diversified client portfolio, characterized by clients across different industries and sectors, generally leads to a higher valuation compared to portfolios concentrated in a few industries or clients. The diverse revenue streams and reduced risk associated with diversified portfolios make them more attractive to investors.

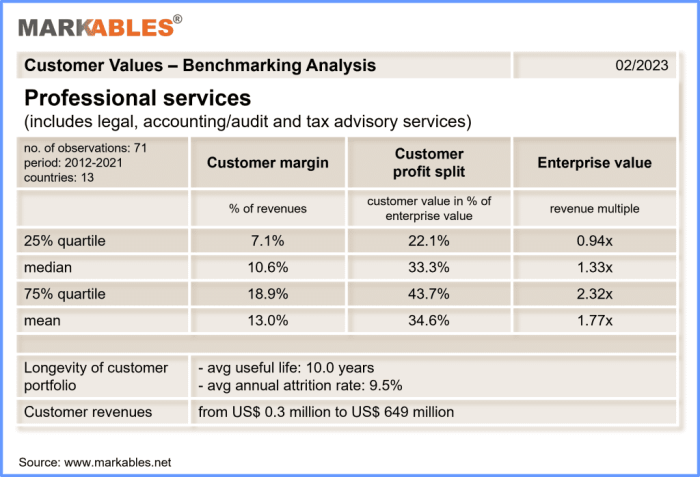

Revenue Streams and Profitability

Professional services firms, unlike product-based companies, often have intricate revenue models that significantly impact their valuation. Understanding these models, their predictability, and the factors driving profitability is crucial for assessing the true worth of such firms. Different revenue structures can create varying degrees of stability and predictability, influencing how investors perceive the long-term potential of the business.

Revenue Models

Professional services firms employ various revenue models. A common approach is project-based billing, where fees are tied to the completion of specific tasks or projects. This model can be less predictable compared to retainer-based arrangements, where a fixed fee is charged for ongoing services. Other models include time-and-materials, where fees are based on the time spent and materials used, and value-based pricing, where fees are determined by the perceived value delivered to the client.

Revenue Predictability and Valuation, 10 characteristics of professional services firms that influence their valuations

The predictability of revenue significantly influences a firm’s valuation. Highly predictable revenue streams, such as those from retainer agreements, tend to command higher valuation multiples compared to project-based models, which often exhibit greater variability. Consistent revenue streams indicate a stronger ability to manage risk and generate stable cash flow, attracting investors seeking dependable returns. Valuation multiples reflect this, with predictable revenue streams commanding a premium.

Profitability Drivers

Several factors contribute to the profitability of professional services firms. High client retention rates indicate a strong value proposition, leading to recurring revenue and increased profitability. Efficient project management, minimizing overhead costs, and effective pricing strategies all contribute to higher profitability. Skilled and experienced professionals are critical, as their expertise directly translates into higher quality work and potentially higher fees.

Successful marketing and sales efforts also directly influence the ability to secure new projects and retain existing clients.

Pricing Strategies and Valuation

Pricing strategies play a crucial role in a firm’s valuation. A clear, transparent pricing structure, coupled with a demonstrable value proposition, builds trust and confidence among clients and investors. Effective pricing strategies reflect the value provided, allowing the firm to command higher fees and improve profitability. Competitive pricing, while crucial, must be balanced with the value offered to clients.

Overly aggressive pricing strategies can negatively impact client relationships and limit long-term revenue.

Diving into the 10 characteristics of professional services firms impacting their valuations is fascinating. Things like reputation, client retention, and the firm’s strategic positioning heavily influence how much they’re worth. But, did you know that optimizing your image use in Google’s Performance Max campaigns ( google image optimization features performance max ) can similarly affect your firm’s visibility and, ultimately, its perceived value in the digital marketplace?

Understanding these key characteristics is crucial for any professional service firm aiming for a robust valuation strategy.

Visual Representation of Revenue and Profitability Data

| Revenue Model | Average Revenue (USD) | Profit Margin (%) | Valuation Multiple (x) |

|---|---|---|---|

| Project-Based | $500,000 | 25% | 6x |

| Retainer-Based | $750,000 | 30% | 8x |

| Value-Based | $1,000,000 | 35% | 10x |

This table illustrates a simplified representation of how different revenue models correlate with profitability and valuation multiples. Note that these are illustrative figures and actual values can vary significantly depending on the specific firm, industry, and market conditions.

Talent Acquisition and Retention

Attracting and retaining top talent is paramount for professional services firms. Highly skilled employees are the lifeblood of these businesses, driving innovation, client satisfaction, and ultimately, firm valuation. A strong talent pool translates directly into a firm’s ability to deliver high-quality services and maintain a competitive edge in the market. This section delves into the critical role of talent in firm valuation.The expertise and experience of employees significantly impact a firm’s valuation.

Firms with deep pools of specialized knowledge, particularly in high-demand areas, are more attractive to potential buyers and command premium valuations. This is because these employees represent a valuable asset, capable of generating revenue and profitability.

Employee Expertise and Firm Valuation

Employee expertise is a crucial determinant of firm valuation. Firms possessing a significant number of experienced professionals in specialized fields command higher valuations than those with less experienced or less specialized teams. This is because these skilled professionals can deliver more complex projects and provide higher-quality services, thereby increasing revenue and profitability. For example, a law firm with numerous experienced litigators in a specific area of law (e.g., intellectual property) would likely command a higher valuation than a firm with a less specialized and less experienced team.

Compensation Structures and Firm Valuation

Compensation structures play a significant role in attracting and retaining top talent. Competitive compensation packages, including salaries, benefits, and bonuses, are essential to attract and retain skilled employees. Attractive compensation packages demonstrate the firm’s commitment to its employees and reinforce its reputation as a desirable employer. A well-structured compensation plan can lead to higher employee satisfaction, reduced turnover, and increased productivity, ultimately benefiting the firm’s valuation.

For instance, a firm offering competitive salaries and performance-based bonuses for key personnel is more likely to attract and retain the best talent, thereby enhancing its valuation.

Employee Training and Development Programs

Investment in employee training and development programs is crucial for maintaining a skilled workforce and enhancing firm valuation. These programs enhance employee skills, increase their knowledge base, and contribute to the firm’s overall expertise. Continued professional development shows a commitment to employee growth, which, in turn, positively impacts firm reputation and valuation. Examples include providing opportunities for certifications, specialized training courses, and mentorship programs to enhance employee skills.

Impact of Different Employee Skill Sets on Firm Valuation

| Employee Skill Set | Impact on Firm Valuation | Example |

|---|---|---|

| Highly specialized expertise (e.g., industry-specific knowledge, specialized software skills) | Significant positive impact on valuation. | A consulting firm with numerous experts in a niche industry (e.g., renewable energy) will command a higher valuation. |

| Project management and leadership skills | Positive impact on valuation. | Firms with employees capable of leading and managing complex projects efficiently will attract clients and improve profitability. |

| Strong client relationship skills | Positive impact on valuation. | A firm with employees who are excellent communicators and build strong client relationships can attract and retain clients, thus increasing revenue and firm valuation. |

| Technical skills (e.g., software proficiency, coding skills) | Positive impact on valuation, especially in technology-focused firms. | A technology firm with skilled developers and engineers will be more valuable than one with less technically proficient staff. |

| Strong analytical skills | Positive impact on valuation. | Consulting firms with employees who can analyze data and provide insightful recommendations are highly valuable. |

Technological Proficiency and Innovation

Professional services firms are increasingly recognizing the critical role of technology in driving operational efficiency and enhancing client service. The ability to leverage technology effectively differentiates firms and significantly impacts their valuation. This section explores the importance of technology adoption, innovation, and digital transformation in shaping the future of these firms.Technological proficiency is no longer a differentiator; it’s a fundamental requirement for success in today’s competitive landscape.

Firms that fail to embrace and effectively integrate new technologies risk losing market share and potentially impacting their valuation. The strategic use of technology can streamline internal processes, improve client communication, and create new revenue streams.

The Role of Technology in Enhancing Operational Efficiency and Client Service

Technology plays a pivotal role in modernizing professional services firms. Automation of routine tasks allows employees to focus on higher-value activities, boosting productivity and profitability. Cloud-based solutions facilitate collaboration and data sharing across teams and with clients, enhancing communication and transparency. Advanced analytics tools enable firms to better understand client needs and market trends, leading to more effective strategies and personalized service.

Examples of How Technology Implementation Affects Firm Valuation

Successful technology implementation demonstrably impacts valuation. Firms that effectively integrate project management software, for example, experience improved project tracking, resource allocation, and ultimately, enhanced profitability. This demonstrably higher efficiency can directly translate to a higher valuation. Similarly, firms that leverage data analytics to personalize client service and identify emerging market opportunities often see a corresponding increase in their market value.

The return on investment (ROI) from successful technology integration is a key factor for investors.

Digging into the 10 key characteristics of professional services firms that affect their valuation is fascinating. A crucial component of this is their go to market strategy, go to market strategy , which significantly shapes their market presence and ultimately, their value. Ultimately, these 10 characteristics, from client relationships to innovation, all contribute to a firm’s overall valuation.

The Importance of Innovation and New Service Offerings in Maintaining a Competitive Edge

Innovation is paramount for professional services firms to maintain a competitive edge and influence valuation. Developing new service offerings that leverage technology creates unique value propositions for clients. For instance, firms incorporating AI-powered tools for legal research or financial modeling can significantly differentiate themselves in the market. This innovation often translates into premium pricing and increased revenue streams, thereby directly influencing the firm’s valuation.

Impact of Digital Transformation on Firm Valuations

Digital transformation is a crucial driver of firm valuation. Firms undergoing successful digital transformations often witness a significant increase in valuation. This is primarily due to improved operational efficiency, enhanced client service, and the creation of new revenue streams. The ability to adapt to technological advancements and integrate them into core business processes becomes a critical success factor.

Firms that successfully embrace digital transformation often demonstrate a higher potential for future growth, which directly impacts their valuation.

Benefits and Costs of Adopting New Technologies

| Type of Professional Services Firm | Benefits of Technology Adoption | Costs of Technology Adoption |

|---|---|---|

| Legal Firms | Improved legal research, document management, client communication, and streamlined litigation processes. | Initial investment in software licenses, training, and potential data migration costs. Potential for staff retraining or restructuring to adapt to new processes. |

| Consulting Firms | Enhanced data analysis, improved project management, and more effective client relationship management. | Investment in advanced analytics tools, potential for integrating multiple software systems, and ongoing maintenance costs. |

| Accounting Firms | Automation of routine tasks, improved financial reporting, and enhanced audit efficiency. | Costs associated with software implementation, training for staff, and data security measures. |

| Financial Services Firms | Improved risk management, enhanced client onboarding, and streamlined investment management processes. | High initial investment in advanced software, potential need for specialized staff training, and regulatory compliance. |

Regulatory Compliance and Risk Management

Professional services firms operate in highly regulated environments. Navigating these complex landscapes and demonstrating robust risk management practices are critical for maintaining client trust and ensuring long-term sustainability. A firm’s ability to adhere to regulations and effectively manage risks directly impacts its valuation. Investors and clients alike scrutinize a firm’s compliance posture, recognizing that violations can lead to significant financial penalties and reputational damage, ultimately impacting profitability and market standing.Strong regulatory compliance and risk management frameworks are not just about avoiding penalties; they are about building a culture of ethical conduct and demonstrating a commitment to client well-being.

This translates into a demonstrable advantage in attracting and retaining talent, a crucial factor in a firm’s overall valuation. Furthermore, a proactive approach to risk management allows firms to identify and mitigate potential threats, ensuring operational stability and minimizing financial losses. This proactive approach is valued by investors and translates directly into a higher valuation.

Impact on Firm Valuation

Regulatory compliance and risk management practices are paramount to a firm’s valuation. A firm’s reputation for adherence to regulations and effective risk management strategies positively influences its value. Non-compliance, on the other hand, can result in significant valuation decreases due to potential penalties, reputational damage, and the loss of client confidence.

Examples of Regulatory Scrutiny

The impact of regulatory scrutiny on firm valuations is readily observable in various sectors. For example, financial services firms face intense scrutiny regarding compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations. Non-compliance can lead to substantial fines and damage a firm’s reputation, thus significantly impacting its valuation. Similarly, in the healthcare sector, failure to adhere to HIPAA regulations can result in hefty penalties and reputational harm, leading to a decrease in valuation.

Thinking about the 10 characteristics of professional services firms that influence their valuations? Things like profitability, client retention, and market share are key. Interestingly, a recent report on Google AI’s impact on email click-through rates (CTR) – like this one on mail online CTR drop – might indirectly affect how these firms operate and are perceived.

Ultimately, the enduring value of these professional services firms still hinges on these core attributes, and a good understanding of market trends.

These examples illustrate the direct link between regulatory compliance and firm valuation.

Significance of Internal Controls and Compliance Procedures

Robust internal controls and compliance procedures are essential for professional services firms. These controls act as a safeguard against potential risks, ensuring that operations are conducted ethically and legally. They are crucial for preventing fraud, errors, and breaches of confidentiality, protecting the firm’s reputation and ensuring the security of client data. Thorough internal controls, demonstrating a proactive stance on compliance, are a strong indicator of sound management and a key factor influencing investor confidence and, consequently, valuation.

How Risk Management Strategies Influence Valuation

Effective risk management strategies are directly correlated with firm valuation. A proactive risk management approach demonstrates a firm’s ability to anticipate and mitigate potential threats. This calculated approach fosters investor confidence, enhancing the firm’s perceived stability and reliability. It also minimizes the risk of unforeseen events and their associated financial and reputational repercussions, thus positively impacting the firm’s valuation.

A strong risk management strategy reduces potential liabilities and demonstrates responsible financial management.

Potential Risks and Mitigation Strategies

| Potential Risk | Mitigation Strategy | Impact on Valuation |

|---|---|---|

| Regulatory non-compliance | Regular compliance audits, training programs, and adherence to best practices. | Negative impact, potentially significant valuation decrease. |

| Data breaches | Robust cybersecurity measures, data encryption, and incident response plans. | Negative impact, potentially significant valuation decrease, especially if involving sensitive client data. |

| Financial fraud | Strong internal controls, segregation of duties, and regular financial audits. | Negative impact, potentially significant valuation decrease, and reputational damage. |

| Reputational damage | Proactive crisis management plans, strong ethical conduct, and transparency. | Negative impact, potential valuation decrease, especially if the damage is substantial. |

| Changes in regulations | Staying informed about evolving regulations, adjusting policies and procedures accordingly, and ongoing training. | Neutral to slightly negative impact, as adapting to changes requires effort and investment. However, proactive adaptation can prevent significant losses and demonstrate adaptability. |

Geographic Reach and Market Presence: 10 Characteristics Of Professional Services Firms That Influence Their Valuations

Professional services firms, from consulting to law, often find their valuations directly tied to their ability to serve clients across diverse geographic locations. A firm with a broad geographic reach can access a larger client base, potentially driving higher revenue and profit margins. This presence is more than just having an office in multiple cities; it involves deep understanding of local regulations, market nuances, and cultural sensitivities.

The international landscape, especially, can significantly impact a firm’s overall valuation.International expansion can dramatically alter a firm’s valuation. Acquiring local expertise and adapting to foreign markets requires significant investment in talent and infrastructure. However, successful internationalization often yields substantial returns. A firm that successfully navigates diverse legal systems and cultural differences can command a premium valuation compared to a firm confined to a single market.

The strategic positioning in international markets reflects not just on the current valuation but also the future potential and scalability.

Significance of Geographic Reach

Geographic reach, encompassing both national and international presence, is a critical factor in determining professional services firm valuation. A firm with a global presence can access a wider client base and tap into a larger pool of talent. This broader reach can significantly enhance revenue streams and improve profit margins, translating directly into a higher valuation.

Impact of International Expansion

International expansion often involves considerable upfront investment. Establishing offices in new markets, hiring local personnel, and navigating different legal and regulatory frameworks can be costly. However, successful internationalization can unlock substantial value. For instance, a law firm with offices in major European and Asian markets may command a higher valuation than one solely focused on the domestic US market.

A successful international strategy often demonstrates a firm’s adaptability and commitment to global growth, which investors recognize as positive factors in valuation.

Influence of Market Presence and Local Expertise

Market presence and local expertise are highly correlated with valuation. A firm’s understanding of local regulations, cultural norms, and market dynamics significantly impacts its ability to serve clients effectively. For example, a consulting firm with deep knowledge of the Chinese market will likely command a higher valuation than one with limited expertise in the region. This is because local expertise allows the firm to better understand the unique challenges and opportunities in the target market, increasing the likelihood of success and driving revenue.

Importance of Regional Market Conditions

Regional market conditions, including economic stability, regulatory frameworks, and industry trends, significantly influence valuation. A firm with a strong presence in regions experiencing economic growth and favorable regulatory environments is more likely to attract investment and command a higher valuation. Conversely, a firm with a substantial presence in a region facing economic downturn or regulatory uncertainty might experience a decrease in valuation.

Impact of Geographic Diversification on Valuation (Illustrative Table)

| Geographic Diversification Level | Valuation Impact | Potential Drivers ||—|—|—|| Limited (Domestic Focus) | Lower valuation | Reduced revenue potential, limited client base || Moderate (Regional Presence) | Moderate valuation | Access to broader client base, improved market penetration || Significant (International Expansion) | Higher valuation | Global reach, access to larger talent pool, diversified revenue streams || Highly Diversified (Global Presence) | Highest valuation | Strong brand recognition, extensive market knowledge, superior risk management |

Financial Performance and Metrics

Financial performance is the bedrock upon which a professional services firm’s valuation rests. Investors scrutinize a firm’s financial health, seeking evidence of profitability, growth potential, and stability. A strong financial performance demonstrates the firm’s ability to generate consistent revenue, manage costs effectively, and deliver returns to stakeholders. This ultimately translates into a higher valuation multiple.The key financial metrics used to assess a professional services firm’s worth are not just numbers; they are indicators of the firm’s operational efficiency, market position, and future prospects.

Understanding these metrics and their interrelationships is crucial for both potential investors and firm leadership. A deep dive into the financial statements and reporting practices is equally important. This helps in deciphering the true financial health of the firm, which in turn, shapes the valuation outcome.

Importance of Financial Performance Indicators

Financial performance indicators (FPIs) are vital in assessing a professional services firm’s valuation. They provide objective measures of profitability, growth, and stability. These indicators help potential investors understand the firm’s historical performance and predict its future potential. By analyzing FPIs, investors can make informed decisions about the firm’s investment worth.

Key Financial Metrics Influencing Valuation Multiples

Several key financial metrics significantly influence valuation multiples for professional services firms. These include profitability, revenue growth, cash flow, and debt levels.

- Profitability: Profitability ratios, such as net profit margin and operating margin, indicate how efficiently a firm converts revenue into profit. High profitability often translates to higher valuation multiples, signifying investor confidence in the firm’s ability to generate returns.

- Revenue Growth: Consistent revenue growth demonstrates a firm’s ability to expand its market share and attract new clients. This consistent growth is often seen as a positive indicator of future potential and a driving force behind higher valuation multiples.

- Cash Flow: Positive and consistent cash flow is critical for professional services firms. It signifies the firm’s ability to meet its obligations and reinvest in its operations. Strong cash flow often translates to a higher valuation multiple, as it assures investors of the firm’s ability to generate consistent returns.

- Debt Levels: High debt levels can negatively impact a firm’s valuation. Excessive debt can increase financial risk, potentially impacting the firm’s ability to generate returns and potentially leading to a lower valuation.

Financial Reporting Practices and Valuation

Financial reporting practices significantly affect valuation. Transparent and consistent financial reporting instills investor confidence. A firm’s adherence to generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) is critical. Accurate and comprehensive reporting ensures that investors have a clear understanding of the firm’s financial health, which is paramount in valuation decisions.

Interpreting Key Financial Ratios

Interpreting key financial ratios is essential for assessing a professional services firm’s valuation. These ratios provide a comparative analysis of the firm’s performance against industry benchmarks and its own historical data. A comprehensive understanding of these ratios helps in making informed investment decisions. Example: Comparing a firm’s debt-to-equity ratio with industry averages provides a comparative analysis.

| Metric | Formula | Interpretation |

|---|---|---|

| Net Profit Margin | Net Income / Revenue | Indicates the percentage of revenue retained as profit after all expenses. |

| Operating Margin | Operating Income / Revenue | Measures profitability from core operations, excluding interest and taxes. |

| Revenue Growth Rate | (Current Year Revenue – Previous Year Revenue) / Previous Year Revenue | Indicates the percentage change in revenue over a period. |

| Debt-to-Equity Ratio | Total Debt / Total Equity | Measures the proportion of debt financing compared to equity financing. |

| Return on Equity (ROE) | Net Income / Average Shareholders’ Equity | Indicates the return generated on the shareholders’ investment. |

Sustainability and Social Responsibility

Professional services firms are increasingly recognizing the critical link between their environmental, social, and governance (ESG) performance and their long-term value. Investors are demanding greater transparency and accountability, and firms that demonstrate strong sustainability and social responsibility practices are better positioned to attract and retain talent, build trust with clients, and ultimately, command higher valuations.This growing emphasis on ESG factors reflects a broader societal shift towards responsible business practices.

Firms that integrate sustainability and social responsibility into their core strategies are not only mitigating risks but also creating opportunities for innovation and growth.

Growing Importance of Sustainability Factors in Valuations

Sustainability and social responsibility are no longer peripheral concerns for professional services firms; they are integral to their financial health and market standing. The increasing scrutiny from investors, clients, and regulatory bodies compels firms to adopt sustainable practices, measure their impact, and report transparently. These factors directly influence investor confidence and ultimately impact valuation multiples.

ESG Factors Affecting Valuations

Environmental, social, and governance factors have a tangible impact on valuation metrics. For example, a firm with a strong track record of reducing carbon emissions or promoting diversity and inclusion may command a higher valuation than a comparable firm with weaker ESG performance. Investors increasingly assess the potential financial risks and opportunities associated with ESG factors, such as regulatory changes, reputational damage, or the cost of inaction on climate change.

Corporate Social Responsibility and Investor Perception

Corporate social responsibility (CSR) initiatives directly impact investor perception. Investors are more likely to support firms that exhibit strong CSR practices, viewing them as more resilient and trustworthy. Strong CSR profiles demonstrate a commitment to long-term value creation, not just short-term profits. This positive perception often translates into a higher valuation.

Impact of Ethical Conduct on Firm Valuation

Ethical conduct and transparency are crucial elements of firm valuation. A firm with a reputation for integrity and ethical practices is seen as more trustworthy and reliable by investors and clients alike. This trust fosters loyalty and strengthens the firm’s ability to attract and retain talent, ultimately leading to higher valuation multiples.

Comparison of Sustainability Initiatives and Valuation Impact

| Sustainability Initiative | Potential Valuation Impact | Example |

|---|---|---|

| Reducing carbon footprint through energy efficiency measures | Increased valuation due to reduced operational costs, lower regulatory risks, and enhanced investor appeal. | A firm implementing renewable energy sources and reducing energy consumption across its offices. |

| Promoting diversity and inclusion in the workforce | Enhanced valuation due to improved employee morale, increased creativity, and better client relations. | A firm actively recruiting and promoting underrepresented groups. |

| Supporting local communities through philanthropic activities | Positive impact on brand reputation and client trust, potentially increasing valuation. | A firm sponsoring local community initiatives or donating to environmental causes. |

| Adopting sustainable supply chain practices | Potential valuation increase due to reduced risk and improved reputation among environmentally conscious investors. | A firm working with suppliers who adhere to environmental and ethical standards. |

The table above illustrates a few examples of how specific sustainability initiatives can impact valuation. The precise impact varies based on the firm’s size, industry, and specific initiatives. The valuation impact often isn’t directly quantifiable, but rather reflects the overall perception of the firm’s commitment to sustainability.

Final Thoughts

In conclusion, the valuation of professional services firms is a multifaceted process, influenced by a complex web of internal and external factors. The ten characteristics highlighted—firm structure, client relationships, revenue streams, talent, technology, compliance, geographic reach, financial performance, sustainability, and social responsibility—all intertwine to create a unique valuation profile for each firm. This comprehensive look at valuation provides crucial insights for understanding the factors that contribute to a professional services firm’s worth, enabling informed decision-making in the dynamic landscape of the industry.